Impressed with their financial expertise, they've boosted my investments and guided me to success. I highly recommend their services

Welcome to Akshar Invest, your trusted financial companion in India. We understand that your financial journey is more than just numbers; it's a story of dreams, aspirations, and the legacy you want to leave behind. At Akshar Invest, we are driven by the belief that everyone deserves a secure and prosperous future.

Our journey began with a simple promise: to empower every individual in India to achieve their financial goals and protect what matters most. We know that life's uncertainties can be overwhelming, but with the right guidance and support, you can navigate them successfully.

Our dedicated team of financial experts is committed to providing you with the best guidance and services tailored to your unique needs. We take pride in the relationships we've built with our clients, and their success stories inspire us every day.

In a rapidly changing world, we remain steadfast in our dedication to helping you secure your financial future. Your dreams are our top priority, and your trust is the cornerstone of our service.

Join us on this journey towards your financial freedom. Let's create a future that's not just financially sound but also peaceful. Together, we can turn dreams into reality.

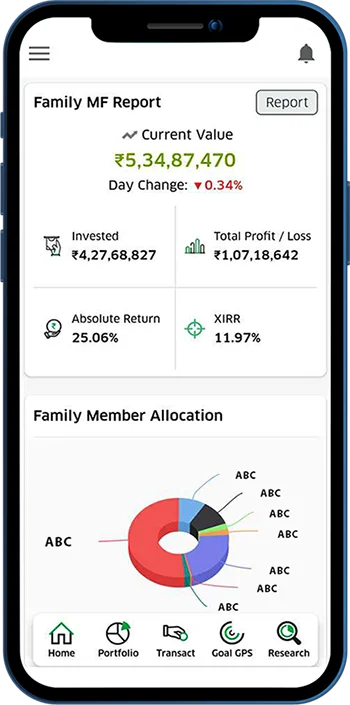

You can track all your investments across different mutual funds through our app.

We made the investment reports very easy through Mutual fund software for distributors, all the key data you can view in a glance. We provide best financial management platform in India to advisors.

We offer a 100% paperless process of investment. It takes a few seconds to register a SIP or Purchase an ELSS.

Give purpose to your investments, you can map all your investments with the goal like child education, marriage or retirement.

Invest in well researched cherry-picked perfectly balanced portfolio.

Products & Services we can help you with.

Impressed with their financial expertise, they've boosted my investments and guided me to success. I highly recommend their services

These experts transformed my finances, securing my future and boosting my investments. It is a game-changer. I highly recommend them

Trustworthy and results-driven, they've reduced the stress of planning my finances, and I'm on track for a prosperous future. My experience is highly satisfying

SIP, or Systematic Investment Plan, is a popular method of investing in mutual funds. It allows investors to contribute a fixed amount at regular intervals, typically monthly. SIPs are designed to make investing easy and affordable for people with different financial goals and risk tolerance.

The right time to start a SIP is now. SIP investments benefit from the power of compounding, where your money earns returns on both the principal and accumulated earnings. Time in the market is more crucial than timing the market. By starting early, you give your investments more time to grow.

The minimum amount for SIP can vary based on the mutual fund scheme and the fund house. However, many mutual funds offer SIPs with a minimum investment of as low as Rs 500 per month, making them accessible to a wide range of investors.

Life insurance provides financial security to your loved ones in case of your demise.

Health insurance covers medical expenses, ensuring you receive quality healthcare without financial stress.

Need Help Feel Free To Contact Us